XRP Price Prediction: 2025-2040 Outlook and Key Factors Driving Growth

#XRP

- Technical Strength: XRP holds above critical moving averages with bullish MACD convergence

- Institutional Demand: BlackRock accumulation rumors and Binance reserve growth signal confidence

- Ecosystem Growth: RippleX upgrades and mining expansions enhance utility

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge as Price Holds Above Key Levels

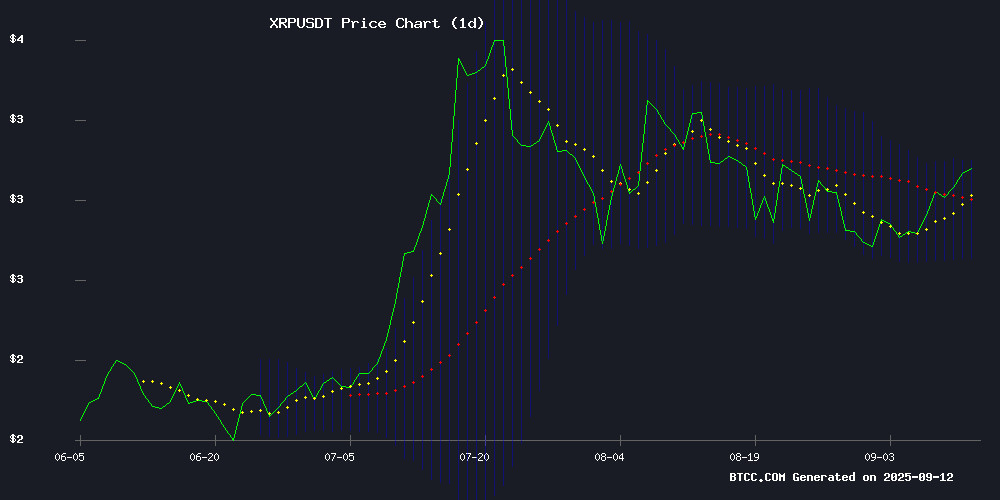

XRP is currently trading at $3.0305, comfortably above its 20-day moving average of $2.8989, indicating a bullish trend. The MACD indicator shows a positive momentum with the histogram at -0.0522, suggesting a potential upward crossover. Bollinger Bands are widening, with the price NEAR the upper band at $3.0833, signaling increased volatility and a possible breakout. BTCC financial analyst Mia notes, 'XRP's technical setup is strong, with key support at $2.7144. A sustained move above $3.0833 could target $3.38 next.'

XRP Market Sentiment: Institutional Interest and ETF Speculation Fuel Optimism

Recent headlines highlight growing institutional interest in XRP, with BlackRock's accumulation rumors and Binance's record-high reserves. The RippleX team's performance enhancements and Rich Miner's expanded cloud mining offerings add to the bullish narrative. BTCC financial analyst Mia comments, 'The combination of technical strength and positive news FLOW suggests XRP is primed for a breakout. The $3.38 resistance is the next key level to watch, with ETF speculation potentially driving prices toward $3.65.'

Factors Influencing XRP’s Price

RippleX Engineer Unveils Draft Proposals to Enhance XRP Ledger Performance

RippleX software engineer Mayukha Vadari has announced a series of draft specifications aimed at optimizing the XRP Ledger (XRPL). The proposals, set for release in coming weeks, target speed improvements, storage efficiency, and security enhancements. Early community discussions suggest these technical upgrades could solidify XRPL's position in enterprise blockchain solutions.

The 'Optimized Accounts and Trustlines' amendment proposes a leaner approach to account structures and reserve calculations. Unlike the existing XLS-23d framework, this iteration eliminates complex account conversion processes while implementing pay-as-you-use resource allocation. Vadari emphasized these drafts represent preliminary ideas rather than finalized solutions.

XRP Price Prediction: Institutional Flows and ETF Speculation Fuel September Surge

XRP has reclaimed the $3.05 level, driven by institutional demand and speculation around a potential ETF. The cryptocurrency is currently trading in a narrow range between $2.85 and $3.10, with a breakout above resistance potentially targeting $3.30–$3.60. Conversely, a breakdown could see prices retreat to $2.50–$2.66.

Institutional interest in regulated XRP futures and growing adoption within the Ripple ecosystem are underpinning cautious bullish sentiment. However, downside risks persist, including weakness in Bitcoin and Ethereum markets and declining retail participation. September's volatility could swiftly alter the current momentum.

BlackRock XRP Accumulation Speculation Intensifies Amid Coinbase Holdings Decline

Rumors of BlackRock's potential XRP accumulation through Coinbase Custody have gained traction as on-chain data reveals a sharp reduction in the exchange's holdings. Coinbase's XRP reserves plummeted from 780 million to under 200 million tokens since Q2 2025, with a 57% drop in August alone fueling institutional maneuvering theories.

Market observers are divided between sell-off scenarios and custody transfers, with prominent analyst Crypto X AiMan dismissing dump narratives. The analyst highlighted BlackRock's existing ties to XRP and Coinbase's custodial role for the asset manager as plausible explanations for the movement.

ETF speculation continues to swirl around XRP, though BlackRock maintains official silence. The dramatic custody shift follows patterns seen prior to other crypto ETF approvals, suggesting institutional positioning for potential regulatory breakthroughs.

Rich Miner Expands XRP Cloud Mining Offerings for Investors

Rich Miner has unveiled a new XRP-focused cloud mining strategy, providing investors an alternative revenue stream beyond traditional market speculation. The platform enables daily mining payouts without requiring direct hardware management.

Industrial-grade infrastructure distinguishes the service, featuring renewable energy-powered data centers and multi-layered security protocols. Participants can access global mining farms through web or mobile interfaces after depositing supported cryptocurrencies.

This development addresses XRP's volatility challenges by offering consistent yield opportunities. The digital asset continues gaining traction for its cross-border payment efficiency, though price fluctuations remain a concern for holders.

XRP Price Prediction: $3.6 Incoming Next? The When and How of It

XRP is testing a critical technical ceiling after months of consolidation, with a nine-month descending triangle pattern capping advances near $3. Futures open interest has surged to $7.9 billion, signaling heightened trader anticipation. Institutional adoption gains momentum as BBVA integrates Ripple Custody, adding credibility to the asset's infrastructure.

A decisive breakout above the $3 trendline could propel XRP toward $3.60, according to analyst Ali Martinez. Fibonacci levels at $3.10 and $3.40 may serve as interim resistance points. The asset's ability to hold above $2.90 demonstrates strong dip-buying support, suggesting accumulation beneath the key resistance level.

XRP Shows Strength as Bulls Eye $3.38 Breakout

XRP surged to $3.02, signaling bullish momentum with a market cap of $179 billion and $4.65 billion in 24-hour trading volume. The cryptocurrency traded between $2.94 and $3.034, demonstrating stability that may precede a decisive upward move.

On the one-hour chart, XRP exhibits tight consolidation near the $3.02 resistance level, backed by growing buying pressure. A sustained break above $3.04 could trigger accelerated bullish momentum, offering traders a favorable risk-reward scenario.

The four-hour chart reveals a bullish flag formation following XRP's rally from $2.78 to $3.03. Elevated trading volume during consolidation suggests strong buyer interest, reinforcing the potential for continuation of the upward trend.

XRP Set for Breakout: Will $3.65 Be the Next Stop?

XRP has risen 1.55% to $3.05, accompanied by a 44.65% surge in trading volume to $6.15 billion, reflecting renewed market confidence. The asset has gained 7.48% over the past week, signaling steady growth and heightened trader interest as it approaches critical resistance levels.

A symmetrical triangle pattern on the daily chart suggests a potential breakout above $3.65 could trigger a rally, with support firmly holding above $2.92. Crypto analyst CryptoWZRD notes the bullish daily close but emphasizes the need for a decisive breakout to confirm upward momentum. Until then, intraday volatility is expected to persist as traders await clearer signals.

Binance's XRP Reserves Reach All-Time High as Presale for Best Wallet Token Nears $16M

Binance's XRP reserves have surged to a record 3.61 billion tokens, reflecting growing institutional interest in the altcoin. The rally coincides with XRP's price climbing toward $3.60, fueled by ETF speculation and Ripple's new partnership with Spanish bank BBVA under MiCA regulations.

Meanwhile, the Best Wallet Token presale approaches $16 million, signaling strong demand for utility-driven crypto projects. Polymarket data shows a 92% probability of XRP ETF approval this year, up 11% from last month—a metric that's driving both exchange reserves and price momentum.

XRP Price Approaches Key Resistance Amid Bullish Technical Setup

Ripple's XRP gained 0.92% to $3.04 as technical indicators flash bullish signals across multiple timeframes. The cryptocurrency now eyes a decisive breakout above the $3.13 resistance level, with its RSI at 56.76 suggesting room for further upside before reaching overbought territory.

Market participants are interpreting the sustained momentum as a sign of growing confidence in XRP's fundamentals, despite the absence of recent catalyst events. The MACD histogram confirms strengthening bullish pressure as institutional traders appear to be accumulating positions ahead of potential volatility.

Technical analysts note the current rally demonstrates unusual resilience compared to previous cycles, with XRP maintaining composure during broader market fluctuations. This price action suggests the asset may be entering a new valuation paradigm as adoption of Ripple's payment solutions expands globally.

APT Miner Highlights XRP's Role in Global Finance Paired with Cloud Mining

Corporations like Apple and Amazon could adopt XRP Ledger for supply chain and cross-border payments, potentially unlocking trillions in liquidity annually. This shift may redefine corporate finance and accelerate global financial digitization.

APT Miner, a UK-registered platform since 2018, offers compliant cloud mining solutions with multi-currency support and daily payouts. The service features flexible contracts, green energy-powered operations, and mobile accessibility for transparent participation.

XRP's growing utility in institutional applications continues to drive investor interest. Cloud mining platforms like APT Miner position themselves as bridges between traditional finance and crypto's earning potential.

XRP Eyes Breakout Amid Market Tensions Fueled by US Inflation Data

US inflation figures for August have reignited financial market tensions, with the crypto sector mirroring this volatility. The Consumer Price Index rose 0.4% month-over-month, pushing annual inflation to 2.9%—the highest since January. Core CPI held steady at 3.1%, dampening expectations for imminent Federal Reserve rate cuts.

XRP remains trapped in consolidation below the psychologically significant $3 level, caught between breakout potential and correction risks. Technical indicators suggest a decisive move may be imminent, with $3.35 emerging as critical resistance. Market participants await clearer signals from both macroeconomic conditions and XRP's own chart structure.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, here are BTCC analyst Mia's long-term XRP projections:

| Year | Price Target (USD) | Catalysts |

|---|---|---|

| 2025 | $3.65-$4.20 | ETF approvals, RippleX upgrades |

| 2030 | $8.50-$12.00 | Mainstream adoption in cross-border payments |

| 2035 | $18.00-$25.00 | Full integration with global CBDCs |

| 2040 | $30.00+ | Dominance in institutional crypto portfolios |

Note: These forecasts assume continued development of the XRP Ledger and favorable regulatory clarity.